Futa Tax Rate 2025 California

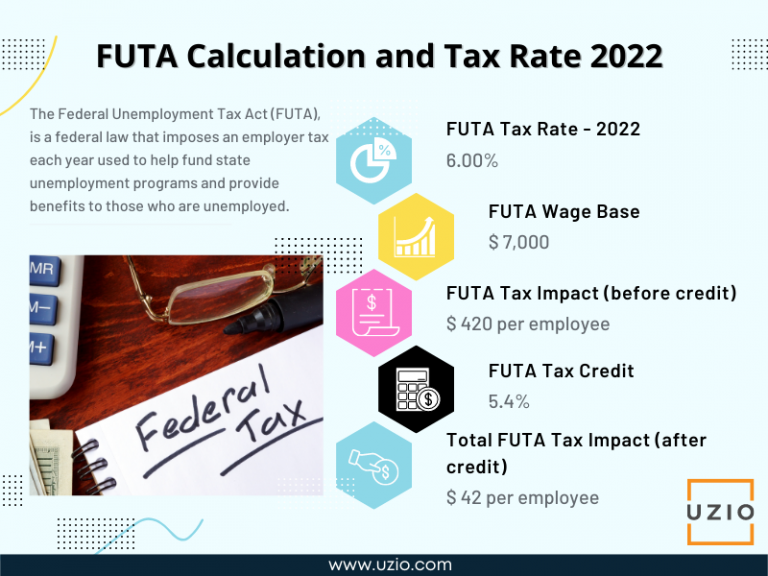

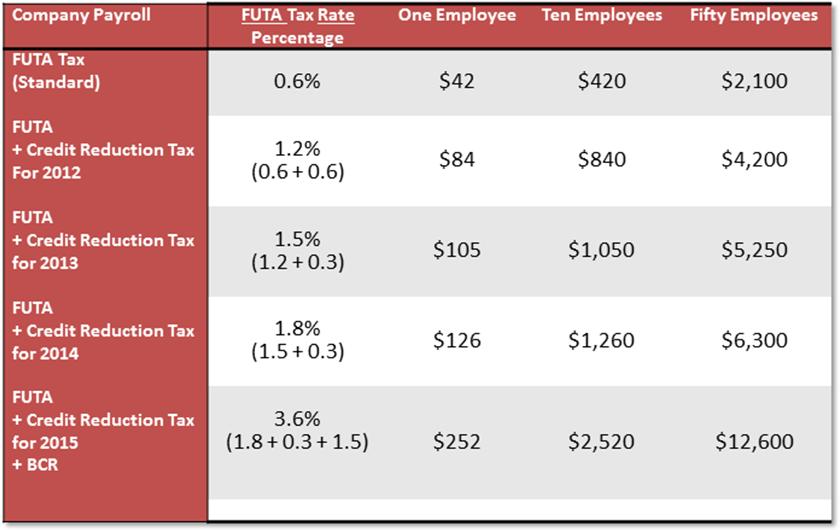

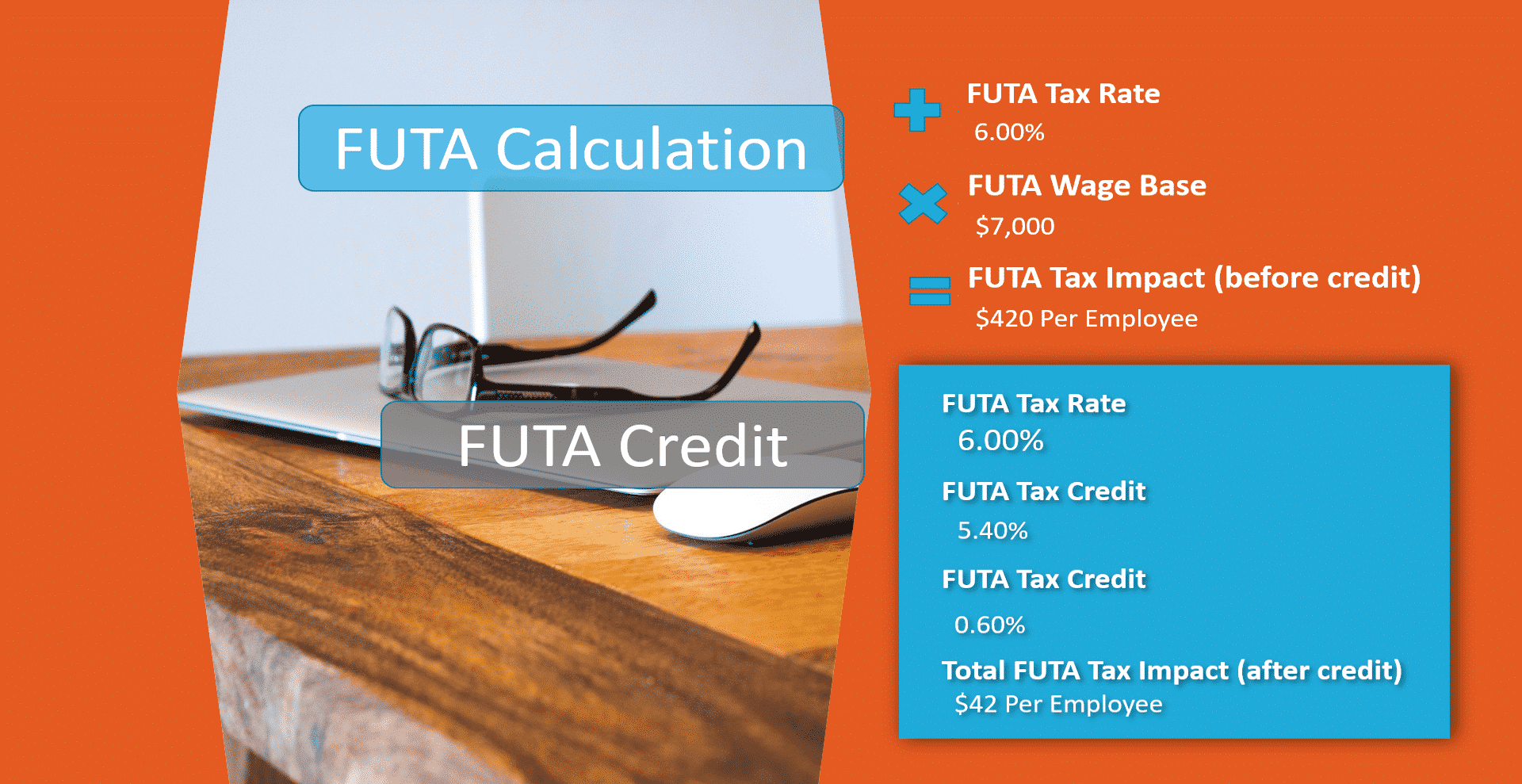

Futa Tax Rate 2025 California. The standard futa tax rate is 6.0% of the first $7,000 of wages that are subject to futa. This equals a standard net rate of 0.6%.

2025 payroll tax rates, taxable wage limits, and maximum benefit amounts unemployment insurance (ui) • the 2025 taxable wage limit is $7,000 per. For the 2025 tax year, the effective california property tax rate was 0.75%.

FUTA Rate Increases for California [Infographic], Expected to be $6.7 billion in 2025, $6.7 billion in 2025 and up slightly to $6.8 billion in 2025. Wages, breaks, retaliation and labor laws.

![FUTA Rate Increases for California [Infographic]](https://blog.accuchex.com/hs-fs/hubfs/ui_tax_increases.jpg?width=1600&height=2400&name=ui_tax_increases.jpg)

FUTA Tax How to Calculate and Understand Employer’s Obligations UZIO Inc, The futa tax rate is 6%, but federal credits decrease the rate to 0.6% for employees in most states (according to the dol, california, connecticut, and. Refer to the california employer’s guide (de 44) (pdf, 2.4 mb).

Federal Unemployment Tax Act (FUTA) Calculation & How to Report, Expected to be $6.7 billion in 2025, $6.7 billion in 2025 and up slightly to $6.8 billion in 2025. The irs issued the annual form 940, employer’s annual federal unemployment (futa) tax return, its instructions,.

FUTA Tax Rate Discover What It Is and How It Works, The futa tax rate is 6%, but federal credits decrease the rate to 0.6% for employees in most states (according to the dol, california, connecticut, and. The interest rate charged on.

FUTA Tax Calculation Accuchex, You will need to pay 6% of the first $7,000 of taxable income for each employee per year. The interest rate charged on.

FUTA Tax Rate 2025, The futa tax levies a federal tax on employers covered by a state’s ui program. However, an allowed credit effectively reduces the tax rate.

What is FUTA? Federal Unemployment Tax Rates and Information for 2025, Most employers receive a credit on their futa taxes of. Futa tax credit, resulting in the state losing a portion of the futa credit retroactively for 2025.

2025 California Tax Brackets Table Maren Sadella, Refer to the california employer’s guide (de 44) (pdf, 2.4 mb). You will need to pay 6% of the first $7,000 of taxable income for each employee per year.

Federal Unemployment Tax Act (FUTA) Calculation & How to Report, The irs today announced that taxpayers in california affected by severe storms and flooding that began on january 21, 2025, now have until june. 2025 payroll tax rates, taxable wage limits, and maximum benefit amounts unemployment insurance (ui) • the 2025 taxable wage limit is $7,000 per.

Form 940 Annual FUTA Tax Return Workful Blog, Expected to be $6.7 billion in 2025, $6.7 billion in 2025 and up slightly to $6.8 billion in 2025. The irs today announced that taxpayers in california affected by severe storms and flooding that began on january 21, 2025, now have until june.

Montana State University Football Schedule 2025. Check back frequently for updates. Live coverage of the montana state bobcats vs. The 2025 sec spring football game schedule has been announced, which incudes 11 games that will be streamed or. Check back frequently for updates.

Ambler Festival 2025. First friday, farmer’s market, car shows and festivals to come. The ambler arts & music festival in ambler, pennsylvania, is an annual celebration that brings together the community in a vibrant showcase of artistic talent and musical. 2025 fire & ice festival. Find above a comprehensive list of ambler festivals, fairs, craft […]

Halloween Baking Championship 2025 Season 9. Watch halloween baking championship — season 9, episode 7 with a subscription on max, or buy it on vudu, amazon prime video, apple tv. Most unpredictable season yet jan 19, 2025. And the results could not have. Watch halloween baking championship — season 9 with a subscription on max, […]